- February 28, 2020

- Posted by: admin

- Category: Business plans, Finance & accounting

Every business large or small must consistently measure the size of the market in which they operate and distil the market trends. The size of the market (or opportunity) may be increasing, shrinking or stagnant. It is an extremely important exercise.

- If the market is increasing in size and your revenue is not increasing proportionately, it means your market share is shrinking and this could be a pointer to potential danger for continuity and survival. It could be due to a variety of reasons which would be discussed in a later write up.

- If the market is shrinking, then all the players in that market are in danger and often implies that there is a new substitute for the product or services. On deeper analysis, it often turns out that the market has been technically expanded by non-traditional alternatives leaving legacy players behind. So, the market for legacy players is shrinking and the growth is happening somewhere else.

- A stagnant market (oscillating very marginally) is a mature market. Healthy players in the market would typically reinvest cash flows in R&D, M&As as they go in search of the next growth wave to surf.

Sizing the market opportunity has to be a very diligent exercise. Not having a proper estimate can be disastrous for a business venture. It could get slightly complicated but to put is simply; the market size is how much money can be made from customers who patronize (or will likely patronize) the products or solutions.

Giving the above definition, it is evident that factors for consideration is sizing a market are three:

- Number of customers (I deliberately would not use the term target market)

- Price

- Frequency

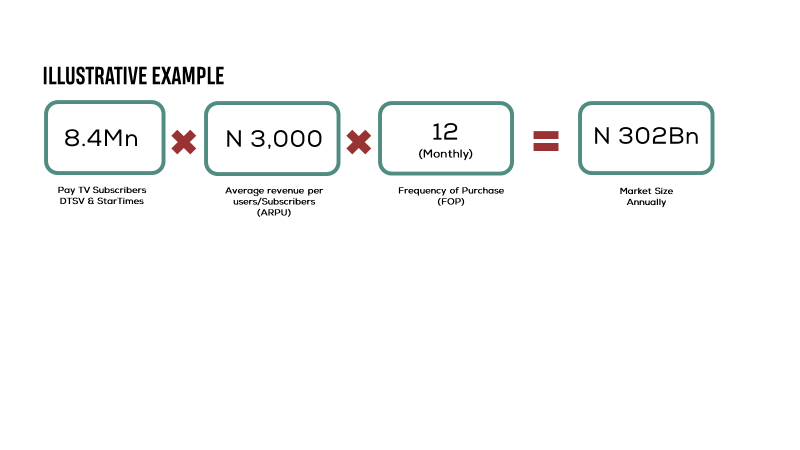

Let’s see a simplified example:

PAY TV MARKET IN NIGERIA.

- Number of PayTV subscribers in Nigeria (take the Oligopolistic Players: DSTV & Startimes) = 8,400,000

- ARPU (Average Revenue per Users/Subscribers) = N3,000

- Frequency of purchase = 12 (i.e. monthly)

- Market Size = 8,400,000 x 3,000 x 12 = N302,000,000,000 (Three hundred and two billion annually).

The above assumes that all subscribers are active and the ARPU is N3,000.

Recall I mentioned earlier that this has to be a diligent exercise and errors could be very dangerous for a business venture. Now let me highlight a possible danger in an evaluation of the above Pay TV scenario. It is easy for a Venturer to say hey! Just 8.4m customers out of a population of 180m?

There is still massive opportunity here. Hmmm….but wait a minute; first you have to look at number of households when it comes to PayTV and not individuals (not minding having included babies, kids and undergrads!). Well, the 180m comes down to about 36m households (we know there are corporate subscribers etc. but they constitute a small fraction). This implies that roughly 25% of the number of households are already covered! Now this is a very important metrics! Why?

Well, not all the 36m households fall into the target market of PayTV! If we go by the socioeconomic stratification of Nigeria, roughly 22% to 26% of the population fall into middle class and above. Some will dispute its less. If you step it down, there is about 31% in the lower-class category and 40% poor/ subsistence. This market (traditional TV) is already being shrunk by on-demand online and offline content streaming platforms. If you apply these ratios to the 36m households, you suddenly find that the market is very likely well occupied and any Venturer into the traditional PayTv market has to contend with snatching subscribers from vested market occupants. This, as some Venturers have found out is a very tough strategy.

NOW, N302Bn is a lot of bread! But the bread can get bigger!! On-demand content streaming will break the “household” constraint. You will find homes where Father, Mother and Teenagers have different subscription accounts on one or more on-demand streaming platforms.

About the Author

Deji Kurunmi is a partner in the Strategy and Financial Advisory Practice.